We know that each customer has specific needs, so we strive to meet those specific needs with a wide array of products, investment tools, mortgages and best of all quality service and individual attention.

Today's technology is providing a more productive environment to work in. For example, through our website you can submit a complete on-line, secure loan application or pre-qualify for a home loan. You may also evaluate your different financing options by using our interactive calculators and going over various mortgage scenarios.

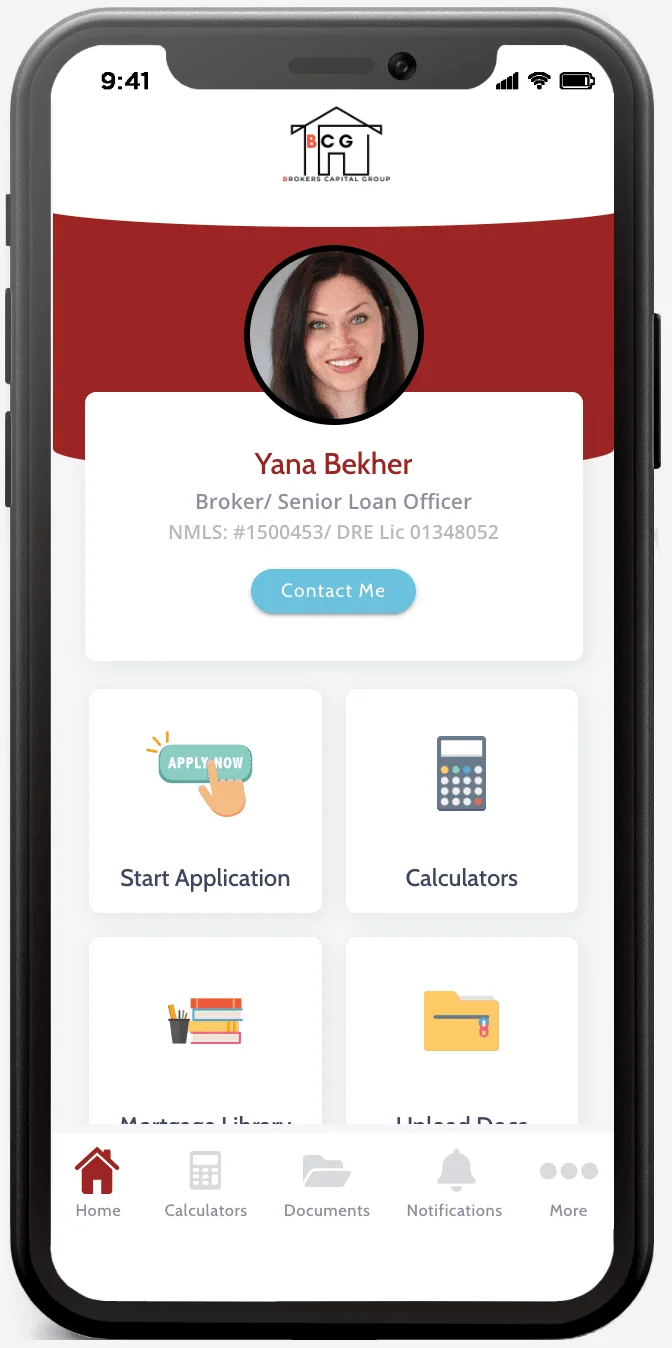

Our Mobile App guides you through your mortgage financing and connects you directly to your loan officer and realtor. This powerful tool walks you step by step through your entice mortgage process.

Learn what options refinancing makes available to you.

Find out what this rate drop means to you for buying a new home.

Find out what the experts are anticipating for 2026 housing